The crypto world will celebrate in 2023 its 15th anniversary since Satoshi Nakamoto registered the bitcoin.org domain, where he published the White Paper of the first cryptocurrency “Bitcoin: A Peer-to-Peer Electronic Cash System”.

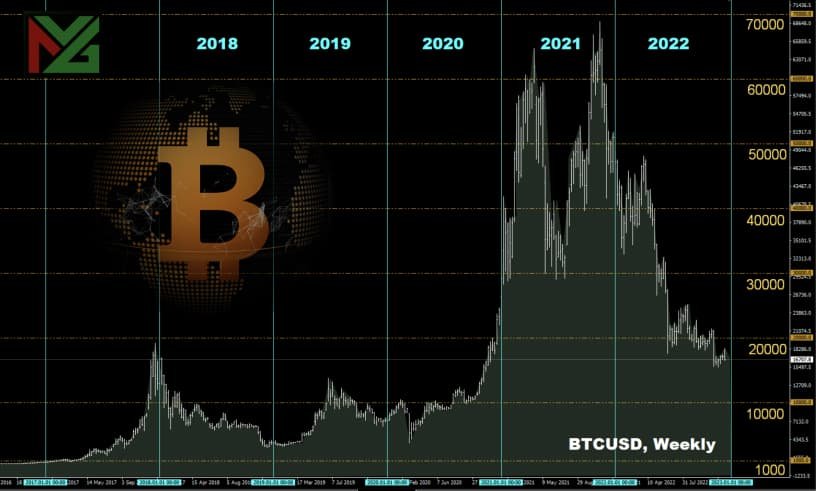

His brainchild has experienced moments of glory and moments of disappointment since then. The price of bitcoin has been soaring into space, then falling into the abyss. The coin has acquired millions of supporters and no less opponents. Some people call it digital gold, while others call it a scam and rubbish. Looking back, we can say that bitcoin has managed to survive even the most difficult times. But what's in store for it in the future? There is still no consensus on this...

2022: Crypto Winter, Crypto Armageddon, Crypto Massacre

These are the epithets that market participants use to describe the cascade of defaults and bankruptcies in the crypto industry in 2022. First, this is the fall of the Luna token and the collapse of the Terra ecosystem in May. The bankruptcy of the second largest crypto exchange FTX in November and the arrest of its founder Sam Bankman-Fried in December. Refusal to withdraw client funds and bankruptcy filings from such whales as Compute North, Voyager Digital, Celsius Network, Three Arrows Capital, and Blockfi. There are now rumors that cast doubt on the fortunes of the Digital

Currency Group and its subsidiaries, two of which are Genesis and Grayscale. The domino effect has already wiped out many of the smaller players in the industry.

And of course, a serious blow to risky assets, including bitcoin and other cryptocurrencies, has been dealt by the US Federal Reserve and other major Central banks, which embarked on the path of fighting inflation, tightening their monetary policy and raising interest rates in the past year. Recall that the printing press worked at full capacity during the COVID-19 pandemic, flooding the markets with flows of cheap liquidity, some of which went to the crypto industry and pushed quotes up. This blessed time has come to an end now.

If the price of bitcoin came close to ,000 in November 2021, it fell below ,500 a year later, in November 2022, shrinking by almost 80%. As a result of all these events, approximately several million customers lost billions of dollars. According to the IntoTheBlock platform, the proportion of wallets that bought BTC at prices higher than today is now over 51%. 24.56 million wallets totaling 47.85 million are currently in losses.

Statistics show that the current crisis is quite accurate in repeating the previous ones. The share of losing addresses reached 55% during the crypto winter of 2018, when the asset fell from ,000 to ,200, and this figure exceeded 62% during the dominance of the bearish trend in 2015. According to the same statistics, it took several months after the 2018 crash before the first noticeable upward momentum appeared.

The calculations made by economists at the Bank for International Settlements look even more apocalyptic. BIS analysts analyzed data on cryptocurrency investors in 95 countries and found that three-quarters of them have lost their money. Moreover, small investors who bought cryptocurrency at the peak, and not at the bottom, have suffered the most.

The report by the analytics firm Glassnode claims that the recent market weakness has “undermined the confidence of bitcoin holders.” According to another survey conducted by Grayscale Investment among ordinary Americans, only 52% of respondents agreed that cryptocurrencies are the financial future. And even fewer respondents (44%) said they were considering investing in digital assets. At the same time, the majority of respondents (81%) agreed that cryptocurrencies need clear regulation rules.

2023: Is Regulation Salvation?

Many experts and investors are now saying that the events of 2022 should bring benefits, clear the industry of unscrupulous participants, and also form clearer rules of the game. That is, lead to the regulation of the market. And although this contradicts the original idea of decentralization and non-control of cryptocurrencies by state institutions, such calls are finding more and more supporters.

Billionaire investor and CEO of Pershing Square Capital Bill Ackman is optimistic that “cryptocurrencies are here to stay, and, with proper supervision, they can benefit society and develop the global economy.” Mastercard Incorporated CEO Michael Miebach agrees with Bill Ackman. In his opinion, this asset class will become much more attractive to people as soon as the supervisory authorities introduce the appropriate rules. Many people want but do not know how to enter the crypto industry and how to get the maximum protection for their assets. BNY Mellon, America's oldest bank, also said that 70% of institutional investors will increase investment in crypto, but they are looking for ways to safely enter the crypto market, and not recklessly invest in the hope of high profits.

Analysts at another major bank, JPMorgan, believe that a series of bankruptcies should encourage regulators to speed up the process of forming regulations that will allow them to effectively control the sector. And the introduction of a comprehensive regulatory framework will facilitate the institutional acceptance of cryptocurrencies. They cite the bill on the regulation of cryptocurrencies in the European Union (MiCA) as an example. The colleagues' opinion was supported by the head of the Onyx blockchain division, Umar Farooq, who noted that regulation is now lagging behind the growth of the industry. And this deters many traditional financial institutions from participating in the market.

One can cite a letter that several US senators sent to the leadership of the holding company Fidelity Investments as confirmation of the above. They called in this letter for a reconsideration of the option to include bitcoin in retirement savings accounts. It was supposed to be available to employees of the 23,000 companies that use Fidelity to manage their .7 trillion (!) retirement plans. “The recent FTX crash has made it clear that the digital asset industry is in serious trouble. It's full of charismatic geeks, opportunistic scammers and self-proclaimed investment advisors who promote products without a proper level of transparency,” the legislators explained their move.

Jon Tester, a member of the US Senate Banking Committee, spoke even harsher. According to him, digital assets failed to pass the “tightness” test. “I have not found anyone who could explain to me what their value is,” the senator said. “The problem is that if we regulate them, people will start to think that crypto assets are really legal.”

There is a saying in the world of finance: "America will sneeze, but the whole world will catch a cold." It is clear from the above that the further behavior strategy of institutional players and large investors will depend on the decisions of the US authorities. This is even more obvious, since 80% of the losses in the market of the main cryptocurrency are now borne by the “whales”: the owners of wallets with a balance of more than 10 thousand BTC coins.

According to US Treasury Secretary Janet Yellen, the failure to regulate cryptocurrencies could harm not only large companies, but the entire US financial system. Another senior official, the head of the US Securities and Exchange Commission (SEC), Gary Gensler, even called this industry the “Wild West”, after which he doubled the staff of his crypto division.

All this was said and done in 2022. However, it is safe to say that the main events in this direction await us in 2023. But what will they be? What path will the authorities take? Will they try to take control of bitcoin? Or simply strangle this competitor of their own money, as billionaire Frank Giustra believes. Time will tell. In the meantime, in this situation of uncertainty, we would like to remind you that MGX Brokers clients can earn money not only from the growth but also from the fall of cryptocurrencies, which significantly expands the horizon of your trading opportunities.